SMALL BUSINESS TAXATION IN NIGERIA

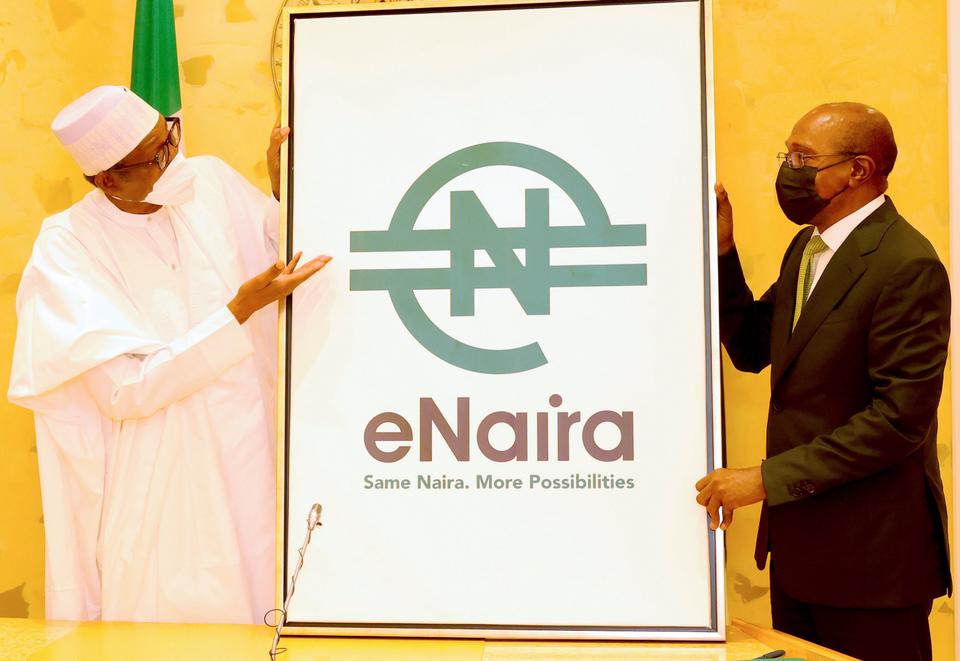

Nigeria becomes the first African nation to roll out digital currency

September 5, 2022

Finance Bill 2021; Proposed Changes to Other Tax and Fiscal Legislations

September 5, 2022Small businesses in Nigeria are liable for various tax obligations to various governments in Nigeria. It is important to know the taxes small businesses will be subjected to before commencing the operation of a small business in Nigeria.

Upon the registration of a business, such business is required to start remitting a certain amount of the profit derived from the business to the government. It is important to state that small businesses are not completely exempted from paying taxes although such businesses are exempted from paying company income taxes depending on the turnover of the company.

Types of taxes to be paid by businesses in Nigeria

- Personal Income Tax- all small business owners are liable to pay their personal income tax which is governed by the Personal Income Tax Act (Cap P8 LFN 2004), for each year of assessment from their source of income for the year, which also includes the profit made in the small business. It is paid as a direct assessment which is applicable to sole proprietors (small business) owners. The tax is paid from the income earned in the preceding year without notice or demand from the relevant tax authority. The deadline for remittance is the 31st of January of the succeeding year. Although the collection of this form of tax is the federal responsibility, it is however collected by the State government through the State Inland Revenue Service (SIRS).

The schedule of chargeable income and the rate of tax to be paid by small business are as follows;

| Annual Income | Personal Income Tax Rate |

| First N300,000.00 | 7% |

| Next N300,000.00 | 11% |

| Next N500,000.00 | 15% |

| Next N500,000.00 | 19% |

| Next N1,600,000.00 | 21% |

| Above N3,200,000.00 | 24% |

- Company Income Tax- this form of tax is paid to the Federal government and it is imposed on the profits of companies incorporated in Nigeria. Although with the new Finance Act 2019, small businesses with an annual turnover of less than N25 Million are now completely exempted from paying company income tax. Hence, the company income tax rate for small businesses with a gross turnover of less than N25 Million Naira is 0%.

- Value Added Tax– small business owners are liable to remit the value-added tax (vat) also known as sales tax, which is imposed on the consumers of their goods and services to the State Inland Revenue Service. The tax is payable on the sales of specific goods and services rendered by small business owners. The tax rate payable on the purchase of certain goods and services is 7.5%.

- Withholding Tax– this is a tax paid from payments due to companies or individuals whether resident in Nigeria or not, that provides goods and services to individuals or companies in Nigeria. The period for filing withholding tax is on or before 21 days after the duty to deduct arose for deductions from companies. It is an advance payment of income tax.

Withholding tax is charged at the rate of five percent (5%) or ten percent (10%) depending o the type of payment or nature of the transaction and also whether the beneficiary of the payment is an individual or a corporation.

- Business Premises Levies– this levy is a form of tax paid on property used for the production of income, office buildings, factories, etc paid to the State government. The tax rate paid is usually N10, 000 (Ten Thousand Naira) for registration and N5, 000 (Five Thousand Naira) for subsequent renewals in respect of urban and N2, 000 (Two Thousand Naira) in rural areas. This form of tax is paid in Lagos State to the Lagos Internal Revenue Service.

Small business owners are also required to register and obtain a Tax Identification Number (TIN) from the State Inland Revenue Service for the purpose of paying their relevant taxes. The TIN is simply an identification number unique to a business owner which is used in the administration of tax and making tax returns to the relevant authority.

Conclusion

Tax payment is important for the growth of a small business and ensuring tax compliance helps to secure the business and avoid any form of default and sanctions. Paying tax as a small business is also advantageous to the business owner as its evidence that the business is a committed one and it helps to also boost the reputation of the business owner especially when dealing with investors.